Bad news for homeowners: Chicago teachers' pension liability may be much larger than expected | Courtesy of Shutterstock

Bad news for homeowners: Chicago teachers' pension liability may be much larger than expected | Courtesy of Shutterstock

The Chicago Teachers' Pension Fund (CTPF) may be considerably less funded than its trustees claim; as a result, Chicago homeowners’ properties could face significant drops in value.

In 2015, the situation was so dire that the law firm of Jones Day recommended -- in a recently released private email to Mayor Rahm Emmanuel -- that the mayor use bankruptcy as a “tool” to escape the Chicago Public School’s pension liabilities.

According to public reports by the Chicago Teachers Union and the state of Illinois, the fund’s nearly $9 billion in unfunded liabilities equates to approximately $7,500 of unseen debt for each of Chicago’s 1.2 million households. This invisible liability does not show up on a title, but it has a significant impact on a property’s value.

The $7,500-per-household figure considers only unfunded teachers pensions, without including myriad other pensions supported by Chicago and Cook County property tax payments, all of which are also unfunded to varying degrees.

The most recent biennial report, published by the Illinois Department of Insurance Public Pension Division, shows CTPF is only 55.6 percent funded: slightly more than half the money necessary to fulfill its promises to current pensioners and future retirees.

But even this dangerously low level may be optimistic.

According to Theodore Konshak, a former pension actuary at the Aon Corp., CTPF might be “cooking the books” to make the fund’s condition appear better than it is. Konshak alleges that, although past underlying salaries were evaluated in accordance with standard practices, a recent formal review does not claim to have used those standards in evaluating future payroll levels.

Actuaries consider multiple factors when judging the health of a pension fund, including how much the fund will receive in contributions each year from future employees.

Konshak claims that CTPF projections of growth in these payments are optimistic. With declining enrollment, Chicago Public Schools will need fewer teachers and have fewer employees to contribute to the fund.

“The average future payroll growth assumption would seem to be closer to zero than to that 3.5 percent assumed by the actuaries,” he said.

Illinois lost more residents than any other state in 2015. According to a recent report in the Chicago Tribune as well as census data released last year, the root of the problem was the Chicago area, which experienced its first population decline since 1990. This overall population decline will likely result in a decline in the student population -- and therefore fewer teachers contributing to the pension system.

According to Konshak, however, the fund’s “actuaries assumed that the actively employed population would remain a constant number throughout their 43-year projection.” He added that the more likely scenario is that payroll will “decline significantly.”

Chicago’s shrinking population makes the pension’s challenges formidable. In 2005, nearly 1.8 active participants were contributing to the pension fund for every retiree. Just 10 years later, the ratio was nearly even -- 1.1 current union employees for every pension recipient. It is likely there will be more retirees than teachers in the very near future.

According to the National Association of State Retirement Administrators (NASRA), public pension plans generally have a target of full funding. For private-sector pensions, the IRS issued guidance as part of the Pension Protection Act of 2006, which also establishes a target of 100 percent funding and considers an 80 percent funding ratio as indicative of a need for corrective action.

If Konshak’s analysis is correct, the fund is actually less than 50 percent funded, and each Chicago household has a much bigger average hidden liability on their home. In many cases, this liability may equal more than the market value of the home itself.

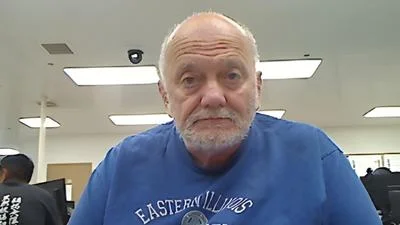

“I have watched property in other states recover from the recession while mine -- while in one of Chicago’s best neighborhoods -- stagnates,” Robert Johnson, longtime homeowner in Chicago’s Lincoln Park neighborhood, said.

Over the years, Chicago mayors have made bargains with union officials that guarantee “defined benefits" for public-sector employees. Defined benefits are specific dollar amounts to be paid at a future date. For the teachers union, such benefits also include cost-of-living-increases to further enhance the value of the deal.

These retirement programs are almost extinct in the private sector, where the current model is based on “defined contributions”; that is, employees and employers contribute specific amounts to a retirement fund, but each retiree’s benefits are based on the performance of the retirement fund’s investments.

While Chicago residents may be party to the deals between the city and the unions, that doesn’t mean that they are aware of the terms that were agreed to on their behalf -- nor what the future consequences of those deals will mean for them.

“There’s too much government and no accountability by those in government,” Johnson said.

Every day, residents make life decisions, such as starting a business or enrolling their children in college, based in part on the value of their primary asset -- usually a home. Public pensions ultimately depend on taxpayers’ ability to make up any shortfall, while the CTPF relies on the one tax Chicago residents cannot escape: property taxes.

Alerts Sign-up

Alerts Sign-up