Chicago public schools face several challenges in filing bankruptcy | Courtesy of Shutterstock

Chicago public schools face several challenges in filing bankruptcy | Courtesy of Shutterstock

The Chicago Public Schools (CPS) system faces a $1 billion budget deficit, and the number of options available to pay that debt are shrinking.

Gov. Bruce Rauner has stated that he is reluctant to bail out the school system and suggested that declaring bankruptcy would be the best option for the beleaguered school system. A similar sentiment was discovered in an email correspondence released by Chicago Mayor Rahm Emanuel.

But what would it look like for a public school system to declare bankruptcy -- and how would it help the city?

Since 1954, only four school systems in the United States have declared Chapter 9 bankruptcy, a financial expert told the Chicago City Wire. Of those four, only two completed the process.

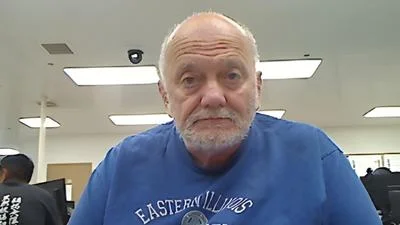

First of all, for the bankruptcy to go through, it would have to pass in the Illinois State Assembly, Mark Glennon, founder of Wirepoints, told the Chicago City Wire.

“But nobody really understands what would happen after that,” he said. “Because no one has done the necessary analysis to understand what all of the unencumbered assets are owned by CPS are. But if I was in charge I would not want to give a final green light on the bankruptcy unless I had a full schedule of assets.”

Glennon went on to explain that CPS has been mortgaging the assets it does own to the hilt so it will be very hard to determine what it still owns and what it could actually leverage in a bankruptcy.

There are a few possible resources -- such as the CPS pension fund debt and its bond debt -- that the school system could call upon, according to Glennon.

“However, to use any of this you would have to find a way around the constitutional prohibition against reducing benefits,” he said. “And in this case, the pension fund is really the 800-pound gorilla in the room.”

Glennon continued by stating that CPS will have to negotiate an agreement that reorganizes the way that money flows to it from the state and the city, because those are its two biggest assets.

“You would want to free that money up from any liens,” he said. “The result is the bond holders might lose out but the tax payers would likely benefit.”

Furthermore, Glennon believes that another challenge stems from the fact that the group responsible for reorganizing CPS under the bankruptcy would be the Chicago Board of Education, the same organization on which Glennon blames most of the school system's current financial challenges.

“One possible solution for this issue would be to make the school board answerable to a financial control board or emergency manager,” he said. “Or to put in place some kind of plan to ensure that the financial stakes are in the hands of the right people.”

In the long run, Glennon sees the biggest benefit of declaring bankruptcy as the opportunity to restructure the district, which would allow it to preserve its current assets and remove any aspects that are a problem.

“You could purchase the old assets from yourself and leave all of the problems behind,” he said. “You could then jettison the pension plan and other issues that have lead to financial problems, such as collective bargaining. This is essentially what GM and Chrysler did during their respective bankruptcies.”

Alerts Sign-up

Alerts Sign-up