A group of industry leaders wants to ice the sweetened beverage tax set to take effect in Cook County on July 1.

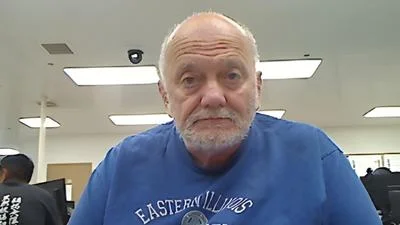

Brian Jordan, president of the Illinois Food Retailers Association, is one of those behind the “Can the Tax” campaign that aims to repeal the 1-cent-per-ounce tax narrowly approved in November by the Cook County Board of Commissioners.

“We need to convince Cook County commissioners to revisit this issue,” Jordan told the Chicago City Wire. “All we have to do is look at Philadelphia to see first-hand how devastating this kind of legislation can be for a county.”

In Philadelphia, lawmakers recently imposed a 1.5-cent-per-ounce tax on sweetened beverages that Bloomberg News reported resulted in sales tumbling by as much as 50 percent for distributors and grocers in some areas, as consumers flocked to outlying counties not impacted by the tax.

In Cook County, the tax is slated to cover an array of products, including soft drinks, fruit juices and energy drinks such as Gatorade, leaving Jordan to fear its impact could be every bit as devastating as those in Philadelphia.

“To put another burden on retailers will definitely impact stores and shops here,” he said. “You reach a tipping point where you can’t bend over any further. Small retailers come to wonder, What am I doing this for?' ”

Meanwhile, Jordan predicts consumers will begin traveling to neighboring states like Indiana to make their beverage purchases, much the same way many now do for items already heavily taxed in Illinois, such as gas, alcohol and tobacco.

Jordan said the “Can the Tax” campaign is designed to educate consumers about what is on the horizon and what it would mean for their bottom line. He is joined in his efforts by Sam Toia, president of the Illinois Restaurant Association, and John Coli Jr., president of Teamsters Local 727.

“We’re hoping as it gets closer to implementation, people will see just how they would be effected by this,” Jordan said. “This tax is unconsciously high for consumers and covers such a wide range of products.”

The revenue generated by the new tax is being touted as part of lawmakers’ overall plans to close a state budget gap now easily stretching into the billions.

Alerts Sign-up

Alerts Sign-up