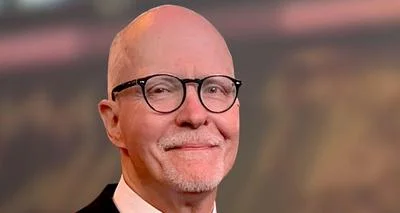

Keefe, Campbell, Biery & Associates Founding Partner Eugene Keefe

Keefe, Campbell, Biery & Associates Founding Partner Eugene Keefe

Businesses contracting independent workers should ensure that those contractors have their own workers compensation insurance coverage to prevent drawn out litigation and potential payouts, attorney Eugene Keefe, founding partner with Keefe, Campbell, Biery & Associates, wrote in a recent blog post.

Keefe sought to clarify how employment relationships can affect workers’ compensation cases. According to Keefe, cases in which there is a question of whether the injured party is an employee or an independent contractor are unpredictable.

Two factors that play strongly into workers’ compensation commissions’ decisions are who has the right to control the work and who has available insurance coverage. Other important factors include the relationship of the work to the overall business of the worker and alleged employer, the method of payment, the right to and means of discharge and who furnished tools materials and equipment for the work.

Because of the stock put into the factor of who has available insurance, also called the "deep pocket" theory, it is critical that any business employing people as individual contractors should require that those contractors present continuing proof of workers’ compensation coverage.

“A good example of this is a truck driver who only delivers loads for one organization, even if the driver owns his own truck and pays all of his own expenses (not including workers’ compensation coverage),” Keefe wrote in his blog post. “…Where the injured individual is left without coverage, the IL WC Commission and courts have gone to great lengths to find that such an individual is an employee.”

Keefe noted that businesses are increasingly attempting to classify workers as independent contractors in an effort to bypass costs like payroll taxes, unemployment benefits and workers’ compensation coverage. States legislatures are working to block this practice and workers’ compensation commissions are increasingly rejecting independent contractor agreements in cases where workers’ compensation benefits come into question.

“Don’t be misled into thinking an ‘independent contractor agreement’ will be necessarily be legally enforceable – in many instances, the Commission or other Board will provide an even higher level of scrutiny when presented such documents,” Keefe wrote. “Only to the extent an injured individual views such a document as legally enforceable and doesn’t seek benefits, it may have its intended informal effect. In our view, the risks are much too high to rely on it.”

While a provision of the Illinois Workers’ Compensation Act allows owners or partners in a company to opt out of coverage for themselves, Keefe noted that allowing a contractor to do so would create a serious exposure for the contracting company, and at the least could create significant legal costs in instances of litigation.

Keefe also provided guidance on a range of other work relationships. He noted the laws surrounding workers’ compensation for undocumented workers is challenging and unclear, and that there is no right answer to solving the issue.

“The whole problem is employers shouldn’t be able to take unfair advantage of hiring an undocumented worker to have that worker become seriously injured or killed without any recourse or benefits for either the worker or their family,” Keefe wrote. “The other side of this same problem is many U.S. employers are presented with and hire workers who are lying or falsifying documents to get hired and then use their faked status as ‘employees’ to make questionable, fraudulent or unsupported WC claims.”

Keefe noted that volunteers are not typically entitled to any workers’ compensation coverage, and that casual and part-time employees are. Employees loaned out to a second business through an contractual relationship or implied relationship are covered by both businesses, with the business they were working for at the time of injury taking on primary liability. If that business does not cover the expenses, however, the original employer is responsible for covering their benefits.

Alerts Sign-up

Alerts Sign-up