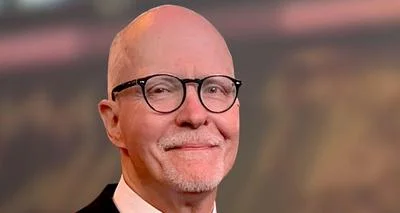

J.B. Pritzker

J.B. Pritzker

Governor-elect J.B. Pritzker has vowed to obliterate the bipartisan school-funding formula that paves the way for the dissemination of private school tax credits after it’s been the law for less than a year.

"I am opposed to that $75 million tax credit, that school voucher program that [Governor Bruce Rauner] has created," WCIA.com reports Pritzker told an Illinois Education Association Professional Development Center audience during the latter days of his campaign. "We should as soon as possible do away with it."

After easily knocking off Rauner in this month’s general election, Pritzker will now have the chance to do what he has so clearly indicated he wants to.

The billionaire businessman has openly derided the plan as a "backdoor voucher program," moving Rabbi Shlomo Soroka, who is director of government affairs for Agudath Israel of Illinois and who openly lobbied Springfield in support of the measure, saying the plan is not a voucher plan but simply a tax voucher program aimed at empowering parents in coming to the best choice for their children.

"This is something totally different,” Soroka told WCIA.com. "Even though the Supreme Court ruled it was not a violation of the state’s constitution to have vouchers in Illinois, this is not a voucher program. This is private citizens giving private donations to a private 501(c)(3) that funds private students to go to private schools.”

Historically, state voucher programs have operated by reimbursing parents up to 75 percent of the tuition money they dole out for private schools. As a stipulation for receiving the new tax credits, donors are obligated to declare they are not "double dipping" by federally claiming the reimbursement as any sort of exemption.

According to WCIA, although he opposes private school tax credits, Pritzker benefits from another tax credit program through his Angel Investment Credit Program, a tax-credit program that pumps “investment dollars into early-stage, innovative companies” across the state. To date, the company has claimed $1.9 million in tax credits for companies owned by the governor-elect.

Pritzker says one critical difference in the way Angel Investment works and what Rauner allowed is that the latter program took money away from the already financially strapped Chicago Public School system.

"I think that, listen, there are lots of reasons why the state provides tax incentives for different things,” he said. “For job creation, for example. Here, what the governor did, it is not the fact that he provided a tax credit for kids to go to school, it is the fact that he took it out of the public school system. He took it out of the public school funding and moved it into this private tax credit. That is a problem because we are already underfunding our public schools."

The new school-funding formula is set to expire after five years. Within hours of the plan having gone into effect, more than 40,000 families had submitted applications for its roughly 12,000 spots.

Alerts Sign-up

Alerts Sign-up