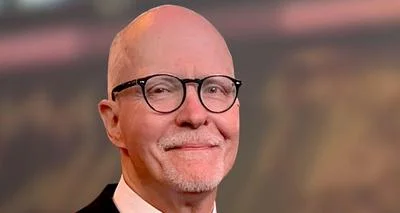

Illinois State Rep. Brad Stephens (R-Rosemont) | Brad Stephens/Facebook

Illinois State Rep. Brad Stephens (R-Rosemont) | Brad Stephens/Facebook

Chicago City Wire recently interviewed Illinois State Rep. Brad Stephens (R-Rosemont) for his opinion on the latest property tax issues in Cook County.

In July, County Board President Toni Preckwinkle announced that the second installment of Cook County property tax bills would be delayed, and there are still multiple steps that need to be completed before the bills can be sent out, the Sun-Times reported. Preckwinkle spokesman Nick Shields said recently that the process should be complete by “the end of 2022." The delay is causing trouble for some homeowners who might be looking to claim an IRS deduction on their 2022 federal tax returns, and it has also hurt some homeowners who have received mortgage bills to add money to escrow accounts for paying tax bills.

“The (banks) are having to use estimates because they don’t have an actual bill, and the banks have been used to getting that bill in July for the last 10 years or so,” Oak Park Township Assessor Ali ElSaffar said, Sun-Times reported. “So we’re getting calls from folks who are dealing with that, and we’re getting calls from folks who are just wondering where their tax bills are.”

The Cook County Assessor’s Office is blaming the delay on a new data system, according to Ryan. This new system apparently delayed the transmission of the final 2021 real estate value assessment data from the Assessor's Office to the Cook County Board of Review by several months. Typically, the second-installment property tax bills are sent out in June and due by Aug. 1.

"My thought is that the time to implement the changes at the assessors were grossly underestimated and the hope is that local governments that rely on real estate tax revenues can sustain the wait for their funds," Stephens said in regards to the delay.

Stephens described the impact the delay has had on his constituents.

"My constituents are concerned about receiving a tax bill at years end and following up with the first installment for the next year in March," Stephens said. "While most who have escrow accounts for taxes shouldn’t be greatly impacted it could be a bit more burdensome to those that haven’t been able to save the money to pay due to the rising inflation."

When asked to characterize Toni Preckwinkle's leadership as County Board President, Stephens said, "I applaud the County Board of Commissioners for stepping up and providing loans to local taxing districts as they wait for the tax revenues to be received."

Cook County has been able to meet the Aug. 1 deadline every year since 2011, with the exception of a two-month delay last year, which was blamed on COVID, according to the Sun-Times. Some officials, including Board of Review Commissioner Larry Rogers Jr., are blaming first-term Assessor Fritz Kaegi for implementing the new data system.

"This is squarely in Fritz Kaegi’s lap. This is purely an implementation failure," Rogers said, according to Sun-Times. "He is the reason tax bills will go out late. He has failed to get his work done timely. He needs to own it."

A spokesperson for Kaegi stated, "These are unavoidable delays. The county was very aware of it."

Alerts Sign-up

Alerts Sign-up