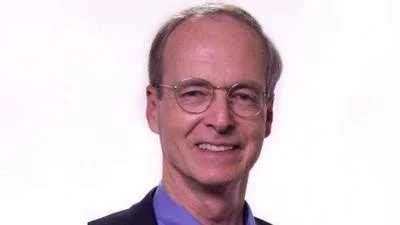

State Senator Mattie Hunter (D) 3rd District. | www.senatorhunter.com

State Senator Mattie Hunter (D) 3rd District. | www.senatorhunter.com

According to the Illinois General Assembly site, the legislature summarized the bill's official text as follows: "Repeals the Senior Citizens and Persons with Disabilities Property Tax Relief Act and removes all cross-references to the Act in various statutes. Amends the Illinois Act on the Aging. Requires the Department on Aging to implement and administer the Benefits Access Program and to establish the eligibility criteria under the program for: (1) the Secretary of State with respect to reduced fees paid by qualified vehicle owners under the Illinois Vehicle Code; (2) special districts that offer free fixed route public transportation services for qualified older adults under the Local Mass Transit District Act, the Metropolitan Transit Authority Act, and the Regional Transportation Authority Act; and (3) special districts that offer transit services for qualified individuals with disabilities under the Local Mass Transit District Act, the Metropolitan Transit Authority Act, and the Regional Transportation Authority Act. Sets forth household income eligibility limits and other eligibility requirements under the program. Authorizes the Department to adopt rules concerning automatic renewals and appeal rights under the program. Makes corresponding changes concerning the program to the Metropolitan Transit Authority Act, the Local Mass Transit District Act, the Regional Transportation Authority Act, the Illinois Public Aid Code, the Older Adult Services Act, and the Illinois Vehicle Code. Further amends the Illinois Act on the Aging by removing a requirement that the Department: (i) study the feasibility of implementing an affirmative action employment plan for the recruitment, hiring, and training of persons 60 years of age or older; and (ii) develop a multilingual pamphlet to assist physicians, pharmacists, and patients in monitoring prescriptions provided by various physicians and to aid persons 65 years of age or older in complying with directions for proper use of pharmaceutical prescriptions. Adds a requirement that the Department implement the Older Americans Act. Removes provisions requiring a Community Care Program Medicaid Initiative and a Community Care Program Medicaid Enrollment Oversight Subcommittee. Makes other changes."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill repeals the Senior Citizens and Persons with Disabilities Property Tax Relief Act and updates various Illinois statutes to reflect this change. It mandates the Illinois Department on Aging to administer the Benefits Access Program, establishing eligibility criteria for reduced vehicle fees, free public transportation for eligible older adults, and individuals with disabilities. The bill sets household income limits for these benefits and authorizes rulemaking for renewals and appeals. Additionally, it amends several acts related to aging, removing some previous study and development requirements, and adds a mandate for implementing the Older Americans Act. The bill includes changes to transit district acts for providing free or reduced transport fares to qualifying individuals. It modifies existing state code sections regarding eligibility for assistance programs, allowing certain benefits to be excluded from income consideration. Furthermore, it addresses the administration of General Assistance, and eligibility standards, and prescribes funding allocations related to these programs. The bill stipulates implementation effective July 1, 2023, contingent upon federal approval for certain provisions.

Hunter graduated from Monmouth College in 1976 with a BA.

Mattie Hunter is currently serving in the Illinois State Senate, representing the state's 3rd Senate District. He replaced previous state senator Elga L. Jefferies in 2003.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| SB1302 | 01/28/2025 | Repeals the Senior Citizens and Persons with Disabilities Property Tax Relief Act and removes all cross-references to the Act in various statutes. Amends the Illinois Act on the Aging. Requires the Department on Aging to implement and administer the Benefits Access Program and to establish the eligibility criteria under the program for: (1) the Secretary of State with respect to reduced fees paid by qualified vehicle owners under the Illinois Vehicle Code; (2) special districts that offer free fixed route public transportation services for qualified older adults under the Local Mass Transit District Act, the Metropolitan Transit Authority Act, and the Regional Transportation Authority Act; and (3) special districts that offer transit services for qualified individuals with disabilities under the Local Mass Transit District Act, the Metropolitan Transit Authority Act, and the Regional Transportation Authority Act. Sets forth household income eligibility limits and other eligibility requirements under the program. Authorizes the Department to adopt rules concerning automatic renewals and appeal rights under the program. Makes corresponding changes concerning the program to the Metropolitan Transit Authority Act, the Local Mass Transit District Act, the Regional Transportation Authority Act, the Illinois Public Aid Code, the Older Adult Services Act, and the Illinois Vehicle Code. Further amends the Illinois Act on the Aging by removing a requirement that the Department: (i) study the feasibility of implementing an affirmative action employment plan for the recruitment, hiring, and training of persons 60 years of age or older; and (ii) develop a multilingual pamphlet to assist physicians, pharmacists, and patients in monitoring prescriptions provided by various physicians and to aid persons 65 years of age or older in complying with directions for proper use of pharmaceutical prescriptions. Adds a requirement that the Department implement the Older Americans Act. Removes provisions requiring a Community Care Program Medicaid Initiative and a Community Care Program Medicaid Enrollment Oversight Subcommittee. Makes other changes. |

| SB1301 | 01/28/2025 | Amends the Deposit of State Moneys Act and the Public Funds Investment Act. Provides that the State Treasurer or any public agency may consider the current and historical ratings that a financial institution has received under the Illinois Community Reinvestment Act when deciding whether to deposit State or public funds in that financial institution. Provides that, effective January 1, 2026, no State or public funds may be deposited in a financial institution subject to the Illinois Community Reinvestment Act unless either (i) the institution has a current rating of satisfactory or outstanding under the Illinois Community Reinvestment Act or (ii) the Department of Financial and Professional Regulation has not yet completed its initial examination of the institution pursuant to the Illinois Community Reinvestment Act. Makes conforming changes. Effective January 1, 2026. |

Alerts Sign-up

Alerts Sign-up