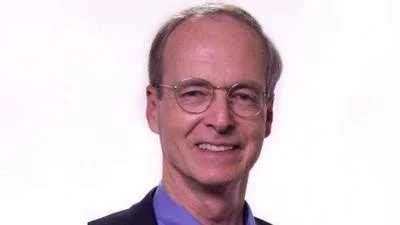

U.S. Rep. Peter Roskam (R-IL) said he now sleeps easier in the wake of the Republican-backed tax reform bill recently becoming the law of the land.

“Having a clear conscious does a lot,” Roskam said during a recent appearance on the "Chicago's Morning Answer" radio show during which he discussed the merits of the law that, among other things, drops the corporate tax rate from 35 percent to 21 percent. “Jan. 1, the withholding table will change, paychecks will be adjusted and businesses can say ‘my business tax is going down and I can start to write this stuff off.’ That’s when we can start to see growth,” he said.

Roskam said those worried about matters such as why the personal exemption was not taken away in the final version of the bill, as previously advertised, can also rest easy.

“It’s been replaced by something better,” he said. “Standard deduction means a husband and wife’s first $24,000 under standard deduction is now tax free.”

"Chicago's Morning Answer" is co-hosted by Dan Proft, who is a principal in Local Government Information Services, which owns this publication.

Roskam further claimed the new law provides tax relief in every bracket, placing a particular emphasis on the middle-class, where he said GOP lawmakers feel the most help is needed.

“The structure of bill (was) designed to offer tax relief and to change the business environment so the U.S. is more competitive,” Roskam said. “This is unlocking, bringing back trillions of dollars based on ridiculous tax policy.”

In the end, Roskam said, he believes the people in his district will be pleased with what the bill does for a state that already touts some of the highest property taxes in the country.

“The good news is all ends are getting tax relief,” he said. “I fought really hard to make sure we can continue to deduct property taxes (up to $10,000). Most of the folks I represent say ‘look I’m interested in tax relief I don’t particularly care about the equation.’ These rates are coming down, the brackets are stretching out we’re getting rid of the alternate minimum tax that hit a lot of people in the 6th (Congressional) District."

Roskam recently told CNN early indications and polling that the bill is unpopular with American taxpayers don’t overly concern him at this point.

“It creates low expectations, and I think that this is going to be far more pleasant for people,” Roskam said on "Chicago's Morning Answer." “What they're going to learn is that their tax bills are going down. Polls are snapshots in time. We use them to guide us, but you don't want to be completely tethered to polls, and I think when it all comes down to it, people are going to look at this in totality when all the dust settles, and say, 'that's a good bill.'"

When all was said and done, Roskam said Republicans decided to stand behind the principle that policymaking decisions should not be made based on polls, but rather solid decision-making and a firm belief that the policy will be in the best interest of the most voters.

“There was a real sense of resolve to get this done,” Roskam said. “The left, their approach was basically hyperbole, overstatement, Armageddon language and it wasn’t persuasive to us.”

Noting that the tax code hadn’t been updated in more than three decades, Roskam said the time was now. “We’re getting a more expansive economy and that is the key,” he said. “We don’t want an economy that’s continuing to grow at this low level. We want an economy that is growing and that is expansive.”

Alerts Sign-up

Alerts Sign-up