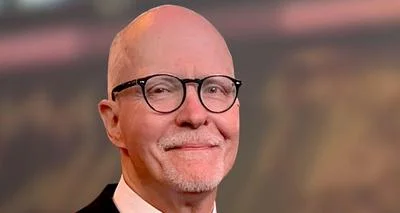

Gov. J.B. Pritzker | File photo

Gov. J.B. Pritzker | File photo

Legislators in the Illinois General Assembly are utilizing a shell bill, passed by the House Executive Committee on Wednesday, in an attempt to reverse tax relief from the federal government. The bill could be both voted on and signed in the same day.

A shell bill is a bill proposed for the purpose of being amended later. The state government of Illinois is currently attempting to save money by eliminating tax loopholes. 440,000 small businesses, which account for 69% of jobs in Illinois, are to be affected by these changes.

"Ready??? #Illinois lawmakers are going to no, not help #smallbusiness, which suffered untold losses during the year of lockdowns" reacted Beverly A. Pekala of Pekala Law on Twitter. "Instead, they're putting the nail in the coffin of the remaining #smallgbiz's by adding $1 billion in taxes"

Business experts reacted to the bill similarly.

“It just takes away an avenue for our small businesses, sole proprietors to be able to recover from this incredible economic damage that’s been done to them over the last year" declared Mark Grant, the Illinois director of the National Federation of Independent Business.

Gov. J.B. Pritzker defended the plan as necessary for the state's revenues.

“There are a number of things that I think should be taken up in the lame duck session – which again is relatively brief – but one of them, which not many people have talked about, is a decoupling issue,” Pritzker said at a press conference on January 6. “There’s a tax provision, as a result of the CARES Act passage, that would essentially deprive Illinois of revenues that it otherwise should get.”

Pritzker has been pushing for the tax relief to be reversed for some time. He first mentioned the ideas as far back as January and did so again in his February State of the State address.

The taxes in question are estimated to save between $500 million and $1 billion for small businesses in the state. 11 business groups as well as the Tax Foundation have advised against reversing the tax relief due to the struggling economy in Illinois.

Alerts Sign-up

Alerts Sign-up