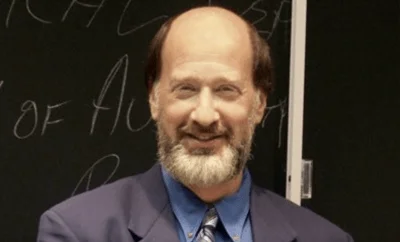

Congressman Danny K. Davis | Congressman Danny K. Davis Official Website

Congressman Danny K. Davis | Congressman Danny K. Davis Official Website

Washington, D.C.- On Thursday, May 25, 2023, Representative Danny K. Davis (D-IL) joined with Representative Blake Moore (R-UT), Representative Gwen Moore (D-WI), Representative Randy Feenstra (R-IA), Representative Don Bacon (R-NE), and Representative Sydney Kamlager-Dove (D-CA) to introduce the bipartisan H.R. 3662, Adoption Tax Credit Refundability Act of 2023. The legislation would make the current Adoption Tax Credit fully refundable, removing income as a barrier to adoption.

The Adoption Tax Credit helps families offset some of the costs of adoption, especially for children with special needs. Currently, the tax credit disadvantages low- and middle-income families, in particular families with annual incomes between $30,000 to $50,000. This inequity is problematic given that approximately half of youth adopted from foster care live in families with incomes at or below 200 percent of the federal poverty level; thus, the credit inadvertently creates barriers to permanency for a substantial number of families. During the Great Recession, Congress made the Adoption Tax Credit refundable recognizing that the economic hardship could prevent families from adopting or exact a heavy financial toll from families choosing adoption. The Adoption Tax Credit Refundability Act of 2023 would again make this credit refundable to remove income as a barrier to adoption to help more children join permanent, loving families.

“The Adoption Tax Credit Refundability Act reflects common-sense federal policy,” said Rep. Davis. “It strengthens families, removes income as a barrier to adoption, and helps vulnerable children join permanent, loving families. Former foster youth represent the majority of children adopted by families earning less than 200 percent of the poverty level. This bill will make a critical difference in the ability of lower and middle-income families to adopt. I am proud to recognize National Foster Care Month by working across the aisle to improve the Adoption Tax Credit to better help more children and families benefit.”

“Even before joining Congress, I have been committed to supporting and engaging with the adoption community in Utah,” said Rep. Moore (UT). “In learning more about their priorities and challenges, it is clear that many families cannot adopt due to financial barriers. On May 25, 2023, I am proud to lead the Adoption Tax Credit Refundability Act in the House as we seek to alleviate these hurdles. This bipartisan bill will make the adoption tax credit fully refundable so that low- and middle-income families can receive the full value of the credit, making it easier for them to open their homes to children in need of forever families.”

"I am pleased to work with Ranking Member Davis, my co-chairs of the Congressional Caucus on Foster Youth, and my other colleagues, on this bipartisan effort,” said Rep. Moore (WI). “This vital legislation holds the power to help transform the lives of countless children and families. By permanently reinstating the refundability of the Adoption Tax Credit, we help lower financial barriers to placing children in loving families permanently and we also ensure that more families, including low and middle-income families, are able to fully benefit from this credit as they open their homes and lives permanently to children in need of adoption. With this bill, we can pave the way for more children who have already suffered much to find permanent homes.”

“As a father of four, I believe that every child deserves a loving family and a safe place to call home. However, we know that too many children in the foster care system are still looking for permanent families,” said Rep. Feenstra. “I’m excited to work with my colleagues to make the Adoption Tax Credit fully refundable, which is a strong policy that ensures that families who want to adopt are not discouraged by costly financial barriers. In Congress, I will continue to advocate for policies that support our families.”

"For years, income has become a roadblock for many families wishing to adopt,” said Rep. Bacon. “As co-chair of the Foster Youth Caucus and an adoptive parent myself, I understand the need to remove this barrier by offsetting these burdensome costs. By making the adoption tax credit fully refundable, this bill makes it easier for families to adopt and gives our nation’s youth a safe, loving, and permanent home. I thank my co-leads for their partnership on this common-sense, bipartisan legislation that is desperately needed on May 25, 2023.”

“As a Co-Chair of the Foster Youth Caucus, I am proud to co-lead the reintroduction of the Adoption Tax Credit Refundability Act with my colleagues,” said Rep. Sydney Kamlager-Dove. “Each and every one of our foster youth deserves to have a loving home, and reducing the financial barrier for low and middle-income families will help ensure this reality. This legislation will help encourage adoption, benefiting our children and creating pathways to permanency. We need more commonsense efforts like this to reform our care system and improve the possibilities for families and children.”

The Adoption Tax Credit Refundability Act of 2023 is supported by the United States Conference of Catholic Bishops as well as 103 Members of the Adoption Tax Credit Working Group, including state and national leaders on child welfare, such as: Academy of Adoption and Assisted Reproduction Attorneys; Child Welfare League of America; Dave Thomas Foundation for Adoption; Generations United; National Council for Adoption; National Foster Parent Association; North American Council on Adoptable Children; Voice for Adoption; and Youth Villages.

Example Statements in Support of the Adoption Tax Credit Refundability Act

"We are grateful to Representatives Danny Davis, Blake Moore, Gwen Moore, Randy Feenstra, Don Bacon, and Sydney Kamlager-Dove for their leadership in making the adoption tax credit available to more families," said Ryan Hanlon, president and CEO of National Council For Adoption. "This bipartisan legislation ensures we assist lower-income families at the same level as middle-income families and supports permanency for children exiting the foster care system to join an adoptive family.”

This bipartisan legislation stands as a beacon of hope, leveling the playing field and extending a helping hand to lower-income families on par with their middle-income counterparts. It champions the cause of permanency for children transitioning out of the foster care system, enabling them to find loving homes through adoption,” said Ligia Cushman, the Executive Director of the North American Council on Adoptable Children who emphasizes that “This transformative legislation addresses the stark reality faced by numerous children adopted from foster care. With the introduction of this legislation, a bright and promising future becomes possible for these vulnerable children, as their families are granted the opportunity to access what they need to thrive."

"Many children adopted from foster care are adopted by families at or near the poverty line and they receive little or no assistance under the current tax credit," said Patrick Lester, Executive Director of Voice for Adoption. "This bipartisan legislation will make adoption possible for many more vulnerable children who need a permanent place to call home."

Original source can be found here.

Alerts Sign-up

Alerts Sign-up