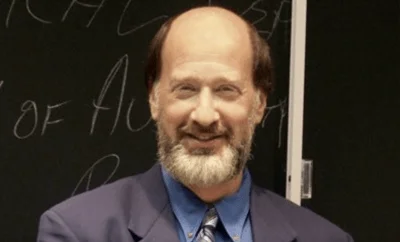

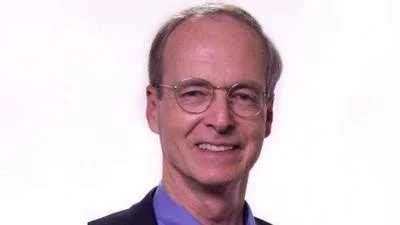

Lissette Castañeda DOH commissioner | City of Chicago Website

Lissette Castañeda DOH commissioner | City of Chicago Website

Two adaptive reuse projects on Chicago’s LaSalle Street will receive $70.5 million and $88 million in Tax-Exempt Housing Revenue Bonds, respectively. The first site, located at 208 S. LaSalle, will receive $70.5 million in Tax-Exempt Housing Revenue Bonds. The $122.7 million project features the conversion of approximately 225,000 square feet into 226 residential units, 68 of which will be affordable at 30% of the Area Median Income (AMI). In addition to the use of tax-exempt bonds and the 4% tax credit equity generated from the bonds, it is anticipated that more funding will also come from TIF funds, a first mortgage, owner equity, and a deferred developer fee.

The second project is located at 111 W Monroe. The building will receive $88 million via Tax-Exempt Housing Revenue Bonds and is projected to cost $208.3 million. It involves the conversion of approximately 342,000 square feet into 345 residential units. Of these units, 103 will be affordable units at 30% of the Area Median Income.

The two renovations come as part of Mayor Johnson’s historic efforts to support the adaptive reuse of four projects in the Loop’s historic financial district. Collectively valued at more than $528 million in development costs, the projects will create more than 1,000 new apartments and 300 affordable units within underutilized office buildings.

Alerts Sign-up

Alerts Sign-up