Lissette Castañeda DOH commissioner | City of Chicago Website

Lissette Castañeda DOH commissioner | City of Chicago Website

The Chicago Department of Housing (DOH), in collaboration with the Chicago Community Loan Foundation (CCLF) and The Resurrection Project (TRP), has initiated a new program aimed at expanding affordable homeownership opportunities. The Shared Equity Investment Program, now open for applications, is designed to foster wealth-building opportunities and support shared equity models of homeownership.

This initiative is part of Mayor Brandon Johnson's broader Community Wealth Building efforts. It aligns with the objectives of the Mayor’s Office of Equity and Racial Justice (OERJ) to promote local, democratic, and shared ownership and control of community assets.

"Through this program, we’re providing Chicagoans with real pathways to affordable homeownership that build wealth and strengthen our communities," stated Mayor Brandon Johnson. "This partnership is a key step in creating lasting, community-owned opportunities that will empower families and foster stability across our neighborhoods."

The program features two tracks: Purchase Price Assistance managed by TRP and Acquisition Support led by CCLF. These organizations were chosen through a Request for Proposals issued by DOH in 2023.

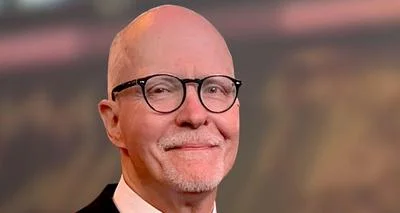

“We’re excited to continue working on new pathways to affordable homeownership,” said DOH Commissioner Lissette Castañeda. “An equity-based, community-led, and anti-displacement focused approach aligns with our department’s mission and doesn’t just create opportunities today, but it also ensures such opportunities are preserved for future homeowners.”

Purchase Price Assistance offers financial aid to reduce the cost of purchasing housing cooperative units, community land trust properties, or deed-restricted units. Participants can receive up to $60,000 for principal write-downs, closing costs, private mortgage insurance premiums, and down payment assistance. Homebuyers earning up to 120% of the Area Median Income (AMI) are eligible.

The Acquisition Support track provides funding for co-ops and CLTs to increase permanently affordable units in Chicago. This track offers up to $100,000 per unit for property acquisition costs, holding costs, and legal expenses. Eligibility requires that 51% of units be priced affordably for households at 80% AMI or below.

“TRP is proud to partner with Mayor Brandon Johnson, the Chicago Department of Housing (DOH), and Chicago Community Loan Foundation (CCLF) to create a better future for Black and Brown families," said Kristen Komara from TRP. “We believe that everyone deserves safe and affordable housing."

“The Chicago Community Loan Fund is honored and enthusiastic to serve as a program administrator for the Shared Equity Investment Program,” said Calvin Holmes from CCLF. “We are proud to participate in strengthening an equitable and inclusive economy."

Applications are available online starting October 29, 2024, through TRP or CCLF. More information about each track can be found at Chicago.gov/SEIP.

Community Land Trusts (CLTs) ensure community stewardship of land by maintaining long-term ownership while selling or leasing housing units. Co-ops allow low- or moderate-income buyers to purchase shares in developments with affordability maintained over time.

Further details on OREJ’s Community Wealth Building work can be accessed at chicago.gov/CommunityWealthBuilding.

Alerts Sign-up

Alerts Sign-up