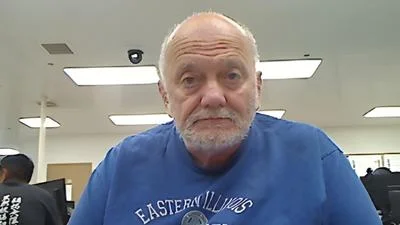

Curtis J. Tarver II, State House of Representatives 25th District. | https://www.ilga.gov/house/Rep.asp?GA=103&MemberID=3145

Curtis J. Tarver II, State House of Representatives 25th District. | https://www.ilga.gov/house/Rep.asp?GA=103&MemberID=3145

According to the Illinois General Assembly site, the legislature summarized the bill's official text as follows: "Amends the Illinois Income Tax Act. Provides that provisions concerning a credit for foreign taxes shall be applied without regard to provisions concerning distributions of investment partnership income to nonresident partners. Effective immediately."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill amends the Illinois Income Tax Act, specifically addressing the application of credits for foreign taxes. It stipulates that the provisions concerning the credit for foreign taxes will be applied without considering the distributions of investment partnership income to nonresident partners. Additionally, the bill specifies that for tax years ending on or after Dec. 31, 2025, the credit calculations for taxes paid to other states will be executed without regard to subsection (c-5) of Section 305. The aim is to clarify and modify how foreign tax credits are applied to ensure consistent tax liability calculations. The bill becomes effective immediately upon becoming law.

Curtis J. Tarver, II has proposed another two bills since the beginning of the 104th session.

Tarver graduated from Iowa State University in 2003 with a BS and again in 2006 from University of Iowa College of Law with a JD.

Curtis J. Tarver Jr. is currently serving in the Illinois State House, representing the state's 25th House District. He replaced previous state representative Barbara Flynn Currie in 2019.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| HB1396 | 01/15/2025 | Amends the Illinois Income Tax Act. Provides that provisions concerning a credit for foreign taxes shall be applied without regard to provisions concerning distributions of investment partnership income to nonresident partners. Effective immediately. |

| HB1373 | 01/15/2025 | Amends the Criminal Code of 2012. Provides that upon recovering a firearm that was (i) unlawfully possessed, (ii) used for any unlawful purpose, (iii) recovered from the scene of a crime, (iv) reasonably believed to have been used or associated with the commission of a crime, or (v) acquired by the law enforcement agency as an abandoned, lost, or discarded firearm, a law enforcement agency shall use the best available information, including a firearms trace (deletes when necessary), to determine how and from whom the person gained possession of the firearm and to determine prior ownership of the firearm. Provides that law enforcement shall use the National Tracing Center of the Federal Bureau of Alcohol, Tobacco, Firearms and Explosives' eTrace platform or successor platform in complying with this provision. Provides that law enforcement shall participate in the National Tracing Center of the Federal Bureau of Alcohol, Tobacco, Firearms and Explosives' eTrace platform or successor platform's collective data sharing program for the purpose of sharing firearm trace reports among all law enforcement agencies in this State on a reciprocal basis. Defines "peace officer" for the purpose of the investigation of specified offenses shall include investigators of the Bureau of Alcohol, Tobacco, Firearms and Explosives. Effective immediately. |

| HB1303 | 01/13/2025 | Creates the Kratom Consumer Protection Act. Provides that no person shall sell, offer for sale, provide, or distribute kratom leaf or a kratom product to a person under 21 years of age, with requirements for online age verification. Provides that no person shall sell, offer for sale, provide, or distribute a kratom product that contains certain chemical compositions. Provides that an individual, business, or other entity shall not produce, sell, or distribute a kratom product that is attractive to children. Provides that no person shall sell, offer for sale, provide, or distribute a kratom product that is adulterated with a dangerous non-kratom substance. Provides that no person shall offer for sale any kratom product that contains synthesized or semi-synthesized kratom alkaloids or kratom constituents. Requires federal compliance for kratom products and processors. Imposes a tax of 5% on the retail sale of kratom products. Requires quarterly returns for the tax. Provides that a person who knowingly files a false or incomplete return is guilty of a Class A misdemeanor. Provides for rulemaking and other powers for the Department of Revenue. Incorporates certain provisions of the Retailers' Occupation Tax Act and the Uniform Penalty and Interest Act. Provides that any person who sells a kratom product in violation of this Act shall be subject to a civil penalty up to $5,000 for the first violation, and up to $10,000 for a second violation. Provides that, for a third violation and each subsequent violation, the person shall be fined a minimum of $10,000, up to a maximum of $20,000, and shall be prohibited from selling kratom products in this State for 3 years. Defines terms. Limits home rule powers. Repeals the Kratom Control Act. |

Alerts Sign-up

Alerts Sign-up