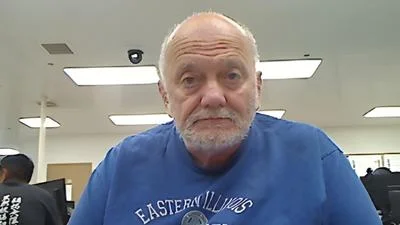

Bill Cunningham, Illinois State Senator from 18th District (D) | https://www.facebook.com/SenatorBillCunningham/

Bill Cunningham, Illinois State Senator from 18th District (D) | https://www.facebook.com/SenatorBillCunningham/

According to the Illinois General Assembly site, the legislature summarized the bill's official text as follows: "Amends the Illinois Income Tax Act. Creates a credit for certain small businesses in an amount equal to the lesser of (i) 10% of the property taxes paid by the qualified small business during the taxable year for eligible real property or (ii) $1,500. Effective immediately."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill amends the Illinois Income Tax Act to introduce a credit for certain small businesses on their property taxes. Specifically, qualified small businesses—those with fewer than 50 employees, current on state and federal tax obligations, and operating within Illinois—can receive a tax credit for tax years ending between Dec. 31, 2025, and Dec. 31, 2029. The credit amount is the lesser of 10% of property taxes paid on eligible non-residential real property or $1,500. Any excess credit that surpasses the tax liability can be carried forward for up to five years. The bill includes provisions for the credit to pass through to partners and shareholders if the business is a partnership or Subchapter S corporation. It becomes effective immediately upon becoming law.

Bill Cunningham has proposed another two bills since the beginning of the 104th session.

Cunningham graduated from the University of Illinois, Chicago in 1990 with a BA.

Bill Cunningham is currently serving in the Illinois State Senate, representing the state's 18th Senate District. He replaced previous state senator Edward Maloney in 2013.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| SB0146 | 01/17/2025 | Amends the Illinois Income Tax Act. Creates a credit for certain small businesses in an amount equal to the lesser of (i) 10% of the property taxes paid by the qualified small business during the taxable year for eligible real property or (ii) $1,500. Effective immediately. |

| SB0145 | 01/17/2025 | Amends the Illinois Income Tax Act. Provides that provisions concerning a credit for foreign taxes shall be applied without regard to provisions concerning distributions of investment partnership income to nonresident partners. Effective immediately. |

| SB0147 | 01/17/2025 | Amends the Criminal Code of 2012. Provides that upon recovering a firearm that was (i) unlawfully possessed, (ii) used for any unlawful purpose, (iii) recovered from the scene of a crime, (iv) reasonably believed to have been used or associated with the commission of a crime, or (v) acquired by the law enforcement agency as an abandoned, lost, or discarded firearm, a law enforcement agency shall use the best available information, including a firearms trace (deletes when necessary), to determine how and from whom the person gained possession of the firearm and to determine prior ownership of the firearm. Provides that law enforcement shall use the National Tracing Center of the Federal Bureau of Alcohol, Tobacco, Firearms and Explosives' eTrace platform or successor platform in complying with this provision. Provides that law enforcement shall participate in the National Tracing Center of the Federal Bureau of Alcohol, Tobacco, Firearms and Explosives' eTrace platform or successor platform's collective data sharing program for the purpose of sharing firearm trace reports among all law enforcement agencies in this State on a reciprocal basis. Defines "peace officer" for the purpose of the investigation of specified offenses shall include investigators of the Bureau of Alcohol, Tobacco, Firearms and Explosives. Effective immediately. |

Alerts Sign-up

Alerts Sign-up