Senator Robert F. Martwick (D), 10th District | senatormartwick.com

Senator Robert F. Martwick (D), 10th District | senatormartwick.com

According to the Illinois General Assembly site, the legislature summarized the bill's official text as follows: "Creates the Fiduciary Oversight Agency Act. Establishes the Fiduciary Oversight Agency within the Department of Insurance. Provides that the Agency shall be responsible for monitoring the operations of all public sector retirement plans in Illinois, including pensions and supplemental retirement plans, to ensure compliance with State laws and fiduciary standards. Grants the Agency the authority to enforce compliance with fiduciary standards and Illinois laws relating to public sector retirement plans through administrative sanctions, penalties, and corrective orders; conduct audits, investigations, and reviews of retirement plans, plan administrators, and other fiduciaries to ensure compliance with State laws and fiduciary standards; and initiate civil or administrative proceedings to address violations of fiduciary standards and enforce corrective actions or penalties as appropriate. Establishes reporting requirements for the Agency."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill establishes the Fiduciary Oversight Agency within Illinois' Department of Insurance to oversee and ensure compliance of all public sector retirement plans, including pensions and supplemental retirement plans, with state laws and fiduciary standards. It grants the agency authority to enforce compliance through administrative sanctions, penalties, and corrective orders; conduct audits and investigations; and initiate civil or administrative proceedings if fiduciary standards or laws are violated. The agency is also tasked with providing guidance and training to stakeholders, reviewing operations of retirement plans, and issuing recommendations to improve transparency and plan health. An annual report summarizing activities, findings, and recommendations will be submitted to the governor and general assembly.

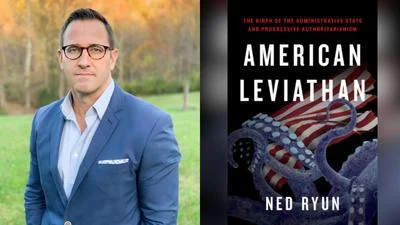

Robert F. Martwick has proposed another 52 bills since the beginning of the 104th session.

Martwick graduated from Boston College in 1988 with a BA and again in 1996 from John Marshall Law School with a JD.

Robert F. Martwick is currently serving in the Illinois State Senate, representing the state's 10th Senate District. He replaced previous state senator John G. Mulroe in 2019.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| SB2282 | 02/07/2025 | Creates the Fiduciary Oversight Agency Act. Establishes the Fiduciary Oversight Agency within the Department of Insurance. Provides that the Agency shall be responsible for monitoring the operations of all public sector retirement plans in Illinois, including pensions and supplemental retirement plans, to ensure compliance with State laws and fiduciary standards. Grants the Agency the authority to enforce compliance with fiduciary standards and Illinois laws relating to public sector retirement plans through administrative sanctions, penalties, and corrective orders; conduct audits, investigations, and reviews of retirement plans, plan administrators, and other fiduciaries to ensure compliance with State laws and fiduciary standards; and initiate civil or administrative proceedings to address violations of fiduciary standards and enforce corrective actions or penalties as appropriate. Establishes reporting requirements for the Agency. |

| SB2220 | 02/07/2025 | Amends the Self-Service Storage Facility Act. Requires that the notice to the occupant in an enforcement of lien action must include the website information where the online bidding of the lien sale may take place, if applicable. |

| SB2221 | 02/07/2025 | Amends the Probate Act of 1975. Provides that in any proceeding to sell or mortgage real estate, if the secured creditors cannot be satisfied in full, then the court may not direct the sale without the secured creditor's approval to accept partial satisfaction; and if the secured creditors cannot be satisfied in full, a sale of the property is not considered necessary for the effective administration of the estate. Effective immediately. |

| SB2281 | 02/07/2025 | Provides that the amendatory Act may be referred to as the Land Conservation Incentives Act. Amends the Illinois Income Tax Act. Provides that, for taxable years beginning on or after January 1, 2025, there is a tax credit of up to $200,000 with respect to qualified real property interest conveyed for conservation and preservation purposes as the qualified donation by the taxpayer, with certain requirements. Provides that any taxpayer claiming this tax credit may not claim a credit under any similar law for costs related to the same project. Provides that any tax credits from the donation of an interest in land made by a pass-through tax entity such as a trust, estate, partnership, limited liability corporation or partnership, limited partnership, S corporation, or other fiduciary shall be used either by such entity if it is the taxpayer on behalf of such entity or by the member, manager, partner, shareholder, or beneficiary, as the case may be, in proportion to their interest in such entity if the income, deductions, and tax liability passes through such entity to such member, manager, partner, shareholder, or beneficiary, and that such tax credits may not be claimed by both the entity and the member, manager, partner, shareholder, or beneficiary for the same donation. Requires the Department of Natural Resources and Department of Revenue to adopt rules. Defines terms. Makes findings. |

| SB2325 | 02/07/2025 | Amends the Business Corporation Act of 1983. In provisions concerning the franchise tax, provides that the rate of penalties and interest on any franchise tax or fee, for which the Secretary of State provides written notice of the amount of penalties and interest owed to a corporation on or after January 1, 2026, shall be the rate of interest established under specified provisions of the Illinois Income Tax Act, and no other penalties or interest shall be imposed or charged to a corporation. Makes changes in provisions concerning the statute of limitations. Makes changes that are declaratory of existing law. Effective immediately. |

| SB1890 | 02/06/2025 | Amends the Property Tax Code. Provides that a copy of the complaint shall also be served on each taxing district in which the property is located at least 90 days prior to the board of review hearing on the complaint. Effective immediately. |

| SB1891 | 02/06/2025 | Amends the University Employees Custodial Accounts Act. Provides that the governing board of any public institution of higher education shall require that the defined contribution plan recordkeeper agree that, in performing services with respect to the defined contribution plan, the recordkeeper: (i) will not use information received as a result of providing services with respect to the defined contribution plan or the participants in the defined contribution plan to solicit the participants in the defined contribution plan for the purpose of cross-selling nonplan products and services, unless in response to a request by a participant in the defined contribution plan or a request by the governing board of the public institution of higher education or its authorized delegate (rather than a request by a participant); and (ii) will not promote, recommend, endorse, or solicit participants in the defined contribution plan to purchase any financial products or services outside of the defined contribution plan, except that links to parts of the recordkeeper's or the recordkeeper's affiliate's (rather than the recordkeeper's) website that are generally available to the public, are about commercial products, and may be encountered by a participant in the regular course of navigating the recordkeeper's or the recordkeeper's affiliate's (rather than the recordkeeper's) website will not constitute a violation. Makes related changes. Effective immediately. |

| SB1892 | 02/06/2025 | Amends the Chicago Police and Chicago Firefighter Articles of the Illinois Pension Code. Provides that a widow's annuity shall be equal to 66 2/3%(instead of 50%) of the retirement annuity the deceased policeman or fireman was receiving at the time of death or 66 2/3% (instead of 50%) of the retirement annuity the policeman or fireman would have been eligible for if the policeman or fireman retired from service on the day before the policeman's or fireman's death. Amends the State Mandates Act to require implementation without reimbursement. |

| SB1893 | 02/06/2025 | Provides that the total payments under a provision concerning the Board providing partial reimbursement of health insurance costs may not exceed $100,000,000 (instead of $65,000,000) in any year. Provides that the amount shall annually thereafter be increased by the annual unadjusted percentage increase (but not less than zero) in the consumer price index for the 12 months ending with the September preceding each November 1, including all previous adjustments. Defines "consumer price index". |

| SB1894 | 02/06/2025 | Amends the State Universities Article of the Illinois Pension Code. Provides that a survivors insurance beneficiary or the personal representative of the estate of a deceased survivors insurance beneficiary or the personal representative of a survivors insurance beneficiary who is under a legal disability may waive the right to receive survivorship benefits, provided written notice of the waiver is given by the beneficiary or representative to the Board of Trustees within 6 months after the System notified that person of the benefits payable upon the death (instead of 6 months after the death) of the participant or annuitant and before any payment is made pursuant to an application filed by such person. Effective immediately. |

| SB1895 | 02/06/2025 | Amends the State Universities Article of the Illinois Pension Code. In provisions concerning the determination of the final rate of earnings for Tier 2 members, provides that, for an employee who is paid on an hourly basis or who receives an annual salary in installments during 12 months of each academic year, the average annual earnings is obtained by dividing by 8 the total earnings of the employee during the 96 consecutive months in which the total earnings were the highest within the last 120 months prior to termination or the average annual earnings during the 8 consecutive academic years of service within the 10 years of service prior to termination in which the employee's earnings were the highest, whichever is greater (instead of only the average annual earnings obtained by dividing by 8 the total earnings of the employee during the 96 consecutive months in which the total earnings were the highest within the last 120 months prior to termination). Provides that the changes made by the amendatory Act are corrections and clarifications of existing law and are intended to be retroactive to January 1, 2011 (the effective date of Public Act 96-1490). Effective immediately. |

| SB1896 | 02/06/2025 | Amends the Illinois Pension Code. Creates the State-Funded Retirement Systems Council to appoint and oversee the Pension Funding Trustee and to monitor and verify State funding to the State-Funded Retirement Systems. Creates the Office of Pension Trustee. Sets forth duties of the Council and Trustee. Provides that the State pledges that the State will not limit or alter certain rights of the Council, the State-Funded Retirement Systems, the Pension Funding Trustee, or the Auditor General under the amendatory Act; alter the method of calculating the minimum required contribution by the State to any State-Funded Retirement System in such a manner as results in a diminution in the contribution amount to a State-Funded Retirement System before the total assets of that System are equal to 100% of the total actuarial liabilities of that System; or use the proceeds of certain income tax surcharges for anything other than certain purposes. Waives sovereign immunity for purposes of the State-Funded Retirement Systems Council. Beginning State Fiscal Year 2026, sets forth a minimum contribution formula for the State-funded retirement systems equal to the sum of the Base Contribution plus the Benefit Change Contribution Amount. Makes conforming and other changes. Provides for transfers from the Budget Stabilization Act from the proceeds of the income tax surcharge under the amendatory Act. Amends the Illinois Income Tax Act. Establishes a surcharge for taxable years 2026 through 2034 for all individuals, trusts, and estates equal to 0.5% of the taxpayer's net income and 0.7% of the net income of all corporations. Makes conforming changes in the Court of Claims Act. Effective immediately. |

| SB1933 | 02/06/2025 | Amends the Downstate Teacher Article of the Illinois Pension Code. Provides that the System shall offer a defined contribution benefit to active full-time and part-time contractual members of the System who are employed by an employer eligible to participate in the defined contribution benefit under applicable law (instead of offering a defined contribution benefit to active members of the System). Makes conforming changes. Provides that a member who is automatically enrolled shall have 3% of his or her pre-tax compensation (instead of pre-tax gross compensation for each compensation period) deferred into his or her deferred compensation account. Provides that a member shall be automatically enrolled in the defined contribution benefit beginning the first day of the pay period following the close of the notice period, or as soon as practicable, unless the employee elects otherwise within the notice period (instead of the member's 30th day of employment). Defines "notice period". Makes changes concerning withdrawal of contributions and forfeiture of employer matching contributions. Provides that active members eligible to participate in the defined contribution benefit do not include employees of a department as defined in the State Employees Article. |

| SB1934 | 02/06/2025 | Amends the General Provisions Article of the Illinois Pension Code. In provisions concerning Tier 2 benefits, provides that the initial survivor's or widow's benefit (instead of the initial benefit) shall be 66 2/3% of the earned annuity without a reduction due to age. Provides that a child's annuity of an otherwise eligible child shall be in the amount and using the formula prescribed under the applicable Article of the Code, and such formula shall be used for calculation of the child's annuity only. Provides that, if a benefit is paid to both a widow or survivor and a child or multiple children, the widow's portion shall be calculated in the amount of 66 2/3% and reduced by the pro rata portion of any child or children's portion as calculated in accordance with the terms of the Article of the Code that is applicable to the pension fund or retirement system that is providing the benefit using the method prescribed in the applicable Article of the Code. Adds child's annuities to provisions concerning automatic annual increases. Amends the State Mandates Act to require implementation without reimbursement. |

| SB1937 | 02/06/2025 | Amends the State Employee Article of the Illinois Pension Code. Provides that a member who is eligible to receive an alternative retirement annuity may elect to receive an estimated payment that shall commence no later than 30 days after the later of either the member's last day of employment or 30 days after the member files for the retirement benefit with the System. Provides that the estimated payment shall be the best estimate by the System of the total monthly amount due to the member based on the information that the System possesses at the time of the estimate. Provides that if the amount of the estimate is greater or less than the actual amount of the monthly annuity, the System shall pay or recover the difference within 6 months after the start of the monthly annuity. Excludes a benefit increase resulting from the amendatory Act from the definition of "new benefit increase". Effective immediately. |

| SB1665 | 02/05/2025 | Amends the Freedom of Information Act. Exempts from disclosure any studies, drafts, notes, recommendations, memoranda, and other records in which opinions are expressed, or policies or actions are formulated, except that a specific record or relevant portion of a record is not exempt if the record has remained in draft form for more than a 12-month period and public dollars were spent by a unit of local government to conduct such a study. |

| SB1666 | 02/05/2025 | Amends the Illinois Human Rights Act. Provides, in the Articles governing employment, financial, and public accommodation discrimination, that the use of criteria or methods that have the effect of causing certain discrimination-related civil rights violations is unlawful, unless (i) the use of such criteria or methods is necessary to achieve a substantial, legitimate, nondiscriminatory interest or (ii) the substantial, legitimate, nondiscriminatory interest cannot be served by another practice that has a less discriminatory effect. |

| SB1667 | 02/05/2025 | Amends the Illinois Trust Code. Requires a trustee to maintain, for a minimum of 7 years after the termination of the trust, a copy of the governing trust instrument under which the trustee was authorized to act at the time the trust terminated. Amends the Revised Uniform Unclaimed Property Act. Provides that property held in an account or plan, including a health savings account, that qualifies for tax deferral under the United States income tax law, is presumed abandoned 20 years after the account was opened. Requires State agencies to report final compensation due a State employee to the Treasurer's Office as unclaimed property if the employee dies while employed. Requires a holder who holds property presumed abandoned to hold the property in trust for the benefit of the State Treasurer on behalf of the owner from and after the date the property is presumed abandoned. Requires that the State Treasurer provide written notice to a State agency and the Governor's Office of Management and Budget of property presumed to be abandoned and allegedly owned by the State agency before it can be escheated to the State's General Revenue Fund if the property remains unclaimed after one year. Creates authority for the Secretary of the Department of Financial and Professional Regulation to order a regulated person under the Act to immediately report and remit property subject to the Act if the Secretary determines that the action is necessary to protect the interest of an owner. Establishes a procedure regulating agreements between an owner or apparent owner and a finder to locate or recover property held by the State Treasurer. Requires a finder to be licensed by the State Treasurer and creates qualifications to be so licensed. Makes definitions. Makes other changes. The Treasurer is authorized to adopt rules as necessary to implement the Act. Effective immediately. |

| SB1668 | 02/05/2025 | Amends the General Assembly, State Employees, State Universities, Downstate Teachers, and Judges Articles of the Illinois Pension Code. Provides that, beginning the first State fiscal year after the total assets of the System are at least 90% of the total actuarial liabilities of the System and each State fiscal year thereafter, the contribution to the System shall be calculated based on an actuarially determined contribution rate. Provides that the System shall calculate the actuarially determined contribution rate in accordance with the Governmental Accounting Research System and officially adopted actuarial assumptions. Provides that the System shall use this valuation to calculate the actuarially determined contribution rate for the next fiscal year. Provides that the actuarially determined contribution rate for a fiscal year shall not be less than the amount for the preceding fiscal year if the ratio of the System's total assets to the System's total liabilities is less than 90%. Provides that the actuarially determined contribution rate shall not be less than the normal cost for the fiscal year. Sets forth provisions concerning reporting and determining the actuarially determined contribution rate. Makes conforming changes. |

| SB1692 | 02/05/2025 | Creates the Local Government Retirement Plan Responsibility Act. Provides that any retirement plan offered by a unit of local government or school district must comply with the applicable provisions of the General Provisions Article of the Illinois Pension Code, including, but not limited to, fiduciary duties, funding, investments, and the rights of participants, regardless of whether the retirement plan is established under the Illinois Pension Code. Defines "retirement plan". |

| SB1693 | 02/05/2025 | Amends the Public Community College Act. Provides for the election (rather than appointment) of the board of trustees of the City Colleges of Chicago beginning with the 2027 consolidated election. Provides that the City of Chicago shall be subdivided into 20 trustee districts by the General Assembly for seats on the board of trustees, in addition to one at-large trustee. Makes related changes. Effective immediately. |

| SB1694 | 02/05/2025 | Amends the Tax Increment Allocation Redevelopment Act of the Illinois Municipal Code. Provides that if (1) 3 or more improved lots, blocks, tracts, or parcels of real property within a single redevelopment project area are purchased by a developer or a developer's parent company or wholly-owned subsidiary, or any combination thereof, within the 3 years prior to the date that the ordinance providing for the tax increment allocation was adopted by the municipality, and (2) an improvement on any of the lots, blocks, tracts, or parcels of real property is demolished or otherwise rendered uninhabitable, then the initial equalized assessed value for the lot, block, tract or parcel of real property shall be the equalized assessed value of the lot, block, tract, or parcel of real property on the date it was purchased by the developer, the developer's parent company, or the developer's wholly-owned subsidiary or purchased by any combination thereof. Limits the provisions to ordinances adopted after the effective date of the amendatory Act. |

| SB1695 | 02/05/2025 | Amends the Tax Increment Allocation Redevelopment Act of the Illinois Municipal Code. Provides that, if a county clerk determines that any lot, block, tract, or parcel of real property within a redevelopment project area is not taxable or has an initial equalized assessed value of $0, then the fair market value of the lot, block, tract, or parcel shall be instead determined by a written MAI-certified appraisal or by a written certified appraisal of a State-certified or State-licensed real estate appraiser. Provides that this reappraisal shall be the initial equalized assessed value of the lot, block, tract, or parcel and shall be added to the total initial equalized assessed value of the taxable real property within the redevelopment project area. Limits the provisions to tax increment allocation financing ordinances adopted after the effective date of the amendatory Act. |

| SB1707 | 02/05/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that a board of 9 (instead of 8) members shall constitute a board of trustees of the fund. Provides that the board shall consist of 4 persons appointed by the mayor of the city; 4 (instead of 3) policemen employed by the city, at least one of whom shall be a lieutenant (instead of a lieutenant or of a rank superior to lieutenant), one of whom shall be of the rank of sergeant, and 2 (instead of one) of whom shall be of the rank of investigator or a rank inferior to that rank; and one annuitant of the fund. Provides that any newly created elected position on the board shall be filled in the same manner as provided for vacant positions. |

| SB1708 | 02/05/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that if a policeman has an application for an ordinary disability benefit denied by a majority vote of the Board of Trustees of the Fund or has a duty disability benefit, ordinary disability benefit, or occupational disability benefit terminated by a majority vote of the Board and brings an action for administrative review challenging the termination or denial of the disability benefit and the policeman prevails in the action in administrative review, then the prevailing policeman shall be entitled to recover from the Fund court costs and litigation expenses, including reasonable attorney's fees, as part of the costs of the action. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1709 | 02/05/2025 | Amends the Illinois Income Tax Act. Creates an income tax credit for taxpayers who have an approved NFPA 13D residential fire sprinkler system installed in a new or existing residential dwelling in the State during the taxable year. Provides that the credit shall be in an amount equal to 50% of the total cost of the installation but not to exceed $10,000 per taxpayer in any taxable year. Provides that credit awards under the amendatory Act shall be limited to the lesser of 2,000 credit awards per year or $8,000,000 in total credits per year. Provides that the credit is exempt from the Act's automatic sunset provisions. Effective immediately. |

| SB1710 | 02/05/2025 | Amends the General Provisions Article of the Illinois Pension Code. Provides that every retirement system, pension fund, or other system or fund established under the Code shall (instead of may) indemnify and protect the trustees, staff, and consultants against all damage claims and suits, including the defense thereof, when damages are sought for negligent or wrongful acts alleged to have been committed in the scope of employment or under the direction of the trustees. Amends the State Mandates Act to require implementation without reimbursement. |

| SB1711 | 02/05/2025 | Amends the Chicago Firefighter Article of the Illinois Pension Code. Provides that, beginning in 2026, the limit on salary for all purposes under the Code for Tier 2 firemen shall annually be increased by the lesser of (i) 3% or (ii) the annual unadjusted percentage increase (but not less than zero) in the consumer price index-u for the 12 months ending with the September preceding each November 1, including all previous adjustments. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1712 | 02/05/2025 | Amends the Chicago Firefighter Article of the Illinois Pension Code. Provides that any active fireman who has completed 7 or more years of service and is unable to perform his duties in the Fire Department by reason of breast cancer resulting from service as a fireman shall be entitled to receive an occupational disease disability benefit during any period of such disability for which he does not have a right to receive salary. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1724 | 02/05/2025 | Amends the Illinois Administrative Procedure Act. Makes a technical change in a Section concerning the short title. |

| SB1725 | 02/05/2025 | Amends the Chicago Police and Chicago Firefighter Articles of the Illinois Pension Code. Provides that the Tier 2 monthly retirement annuity shall be increased on the January 1 occurring either on or after (i) the attainment of age 55 (instead of age 60) or (ii) the first anniversary of the annuity start date, whichever is later. Provides that each annual increase shall be calculated at 3% (instead of 3% or one-half the annual unadjusted percentage increase in the consumer price index-u, whichever is less) of the originally granted retirement annuity. In a provision specifying an annuity reduction factor for each year a retiring Tier 2 policeman or fireman is under the age of 55, provides that the retirement annuity of a policeman or fireman who is retiring after attaining age 50 with 20 or more years of service shall not be reduced. Makes a conforming change. Amends the State Mandates Act to require implementation without reimbursement. |

| SB1726 | 02/05/2025 | Amends the Illinois Pension Code. Provides that a Tier 2 investigator for the Department of the Lottery is entitled to an annuity under the alternative retirement annuity provisions only if the person has withdrawn from service with not less than 20 years of eligible creditable service and has attained age 55. Authorizes an investigator for the Department of the Lottery to establish eligible creditable service under the alternative retirement annuity provisions. Provides that a specified educational requirement for persons employed by the Department of Juvenile Justice shall no longer determine eligibility to earn eligible creditable service under the alternative retirement annuity provisions and authorizes the conversion of service credit to eligible creditable service. Establishes a deferred retirement option plan for certain police officers, firefighters, sheriff's law enforcement employees, and deputy sheriffs in the Cook County Police Department who are otherwise eligible to retire under which a participant may continue in active service for up to 5 years while having his or her retirement pension paid into a special account. Provides that the election to participate in the deferred retirement option plan must be made before January 1, 2030. Provides that the Retirement Systems Reciprocal Act (Article 20 of the Code) is adopted and made a part of the Downstate Police, Downstate Firefighter, Chicago Police, and Chicago Firefighter Articles. In the Chicago Teacher Article of the Code, makes changes to how days of validated service are computed. Amends the State Mandates Act to require implementation without reimbursement. Makes other changes. |

| SB1738 | 02/05/2025 | Amends the Code of Civil Procedure. Changes disclosure in notice provisions to a judgment debtor in a citation to discover assets. Defines "consumer debt judgment". Creates an automatic exemption for a judgment debtor against execution in a consumer debt judgment. Provides that "automatic exemption" means the right of a judgment debtor, against whom a consumer debt judgment has been entered on or after January 1, 2020, to receive $1,000 of the judgment debtor's equity interest in personal property held in a checking, savings deposit account, or credit union account by a third-party citation respondent or garnishee. Provides that the automatic exemption is part of the judgment debtor's current exemption in any personal property not to exceed $4,000 in value. Makes other changes to personal property exemptions as follows: increases the exemption from $2,400 to $3,600 for a motor vehicle and from $1,500 to $2,250 in any implements, professional books, or tools of the debtor's trade. Increases the homestead exemption from $15,000 to $50,000 for one individual and to $100,000 if 2 or more individuals own the property. Makes changes to the list of items of personal property that are exempt from execution. Changes limitations for a revival of judgment for consumer debt entered before January 1, 2020, for a consumer debt judgment entered into after that date but before the effective date of the amendatory Act, and for a consumer debt judgment entered into after the effective date of the Act. Makes other changes. Amends the Clerks of Courts Act. Prohibits a fee from being charged under the Act for the filing of an appearance by a defendant in a small claim proceeding. Effective January 1, 2026. |

| SB1739 | 02/05/2025 | Amends the Illinois Income Tax Act. Provides that, for the purpose of allocating gains and losses from sales or exchanges of shares in a Subchapter S corporation or from interests in certain partnerships, those gains and losses shall be allocated in proportion to the average of the pass-through entity's Illinois apportionment factor in the year of the sale or exchange and the 2 tax years immediately preceding the year of the sale or exchange. Provides that, if the pass-through entity was not in existence during both of the preceding 2 years, then only the years in which the pass-through entity was in existence shall be considered when computing the average. |

| SB1450 | 01/31/2025 | Amends the Chicago Teacher Article of the Illinois Pension Code. Provides that when computing days of validated service, contributors shall receive the greater of: (1) one day of service credit for each day for which they are paid salary representing a partial or a full day of employment rendered to an employer or the Board of Trustees of the Fund; or (2) 10 days of service credit for each 10-day period of employment in which the contributor worked 50% or more of the regularly scheduled hours (instead of one day of service credit for each day for which they are paid salary representing a partial or a full day of employment rendered to an employer or the Board). |

| SB1451 | 01/31/2025 | Amends the General Assembly Article of the Illinois Pension Code. Provides that, in any fiscal year in which the total assets of the System are at least 90% of the total actuarial liabilities of the System, the minimum contribution by the State for that fiscal year shall be the System's normal cost for the fiscal year, plus a supplemental payment in any year in which the total assets of the System are less than 120% of the total actuarial liabilities. Provides that the supplemental payment is to be calculated by using a 30-year rolling amortization to target a ratio of the System's total assets to the System's total actuarial liabilities of 120%. Provides that, if the ratio of the System's total assets to the System's total actuarial liabilities is 120% or greater, but 130% or less, the State is only obligated to make a payment of the normal cost for the fiscal year. Provides that, in any fiscal year in which the ratio of the System's total assets to the System's total actuarial liabilities exceeds 130%, no payment, either for the normal cost or a supplemental payment, shall be paid to the System. Makes conforming changes. |

| SB1452 | 01/31/2025 | Amends the School Code. Authorizes the Chicago Board of Education, by resolution, to provide for the compensation of its members. |

| SB1453 | 01/31/2025 | Amends the State Universities Article of the Illinois Pension Code. Provides that the System shall require that the deferred compensation recordkeeper agree that, in performing services with respect to the deferred compensation plan, the recordkeeper: (i) will not use information received as a result of providing services with respect to the deferred compensation plan or the participants in the deferred compensation plan to solicit the participants in the deferred compensation plan for the purpose of cross-selling nonplan products and services, unless in response to a request by a participant in the deferred compensation plan or a request by the System (currently, a request by a participant in the deferred compensation plan); and (ii) will not promote, recommend, endorse, or solicit participants in the deferred compensation plan to purchase any financial products or services outside of the deferred compensation plan, except that links to parts of the recordkeeper's or the recordkeeper's affiliate's (currently, recordkeeper's) website that are generally available to the public, are about commercial products, and may be encountered by a participant in the regular course of navigating the recordkeeper's or the recordkeeper's affiliate's website (currently, recordkeeper's) does not constitute a violation of the prohibition. Amends the University Employees Custodial Accounts Act. Makes similar changes. In a provision prohibiting a defined contribution plan recordkeeper from promoting credit cards, life insurance, or banking products, provides an exception if a request to provide those products is made by the governing board of the public institution of higher education or its authorized delegate. Effective immediately. |

| SB1454 | 01/31/2025 | Amends the Chicago Police, Chicago Firefighter, and Chicago Municipal Articles of the Illinois Pension Code. Provides that a person who becomes a member on or after January 1, 2026 shall be automatically enrolled into a federal tax qualified pre-tax retirement plan that is otherwise allowed by State and federal law. Provides that a member subject to automatic enrollment shall have the option to opt out of the plan and shall be informed of that option within 30 days after being hired. Provides that if another option is not chosen by the member, the default employee contribution to the account shall be 3% of the member's salary. Provides that the plan administrator may automatically increase members contributions by no more than 1% per year, and a member may choose to opt out of the automatic increases. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1455 | 01/31/2025 | Amends the Deferred Compensation Article of the Illinois Pension Code. Provides that, after January 1, 2026, the deferred compensation plan shall provide for the recovery of the expenses of its administration by charging fees equitably prorated among the participating employers (instead of by charging administrative expenses against the earnings from investments or by charging fees equitably prorated among the participating State employees or by such other appropriate and equitable method as the Illinois State Board of Investment shall determine). Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1456 | 01/31/2025 | Amends the General Provisions Article of the Illinois Pension Code. Provides that the amendatory Act may be referred to as the Pension Board Member Training Act. Provides that the Department of Insurance shall develop and implement a curriculum designed to provide pension board members with necessary education on specified topics, including legal and fiduciary responsibilities, investment strategies, ethical considerations, and actuarial assessments and reporting requirements. Provides that the curriculum shall be made available online to all pension board members. Requires every pension board member to complete the training provided by the Department on an annual basis. Provides that attendance at pension board meetings shall not be deemed to fulfill the annual training requirement. Sets forth provisions concerning definitions; Department responsibilities and rulemaking; and documentation. |

| SB1458 | 01/31/2025 | Amends the Firearm Concealed Carry Act. Provides that if a concealed carry licensee leaves his or her vehicle unattended, he or she shall store the firearm out of plain view in a safe or other secure container which, when locked, is incapable of being opened without the key, keypad, combination, or other unlocking mechanism and is capable of preventing an unauthorized person from obtaining access to and possession of the weapon contained therein and shall be fire, impact, and tamper resistant. For the purposes of this provision, a glove compartment, glove box, or center console is not considered an appropriate safe or secure storage container. Provides that when leaving his or her vehicle unattended, a concealed carry licensee shall store his or her loaded or unloaded firearm out of plain view in a safe or other secure container which, when locked, is incapable of being opened without the key, keypad, combination, or other unlocking mechanism and is capable of preventing an unauthorized person from obtaining access to and possession of the weapon contained therein and shall be fire, impact, and tamper resistant. For the purposes of this provision, a glove compartment, glove box, or center console is not considered an appropriate safe or secure storage container. Provides that a concealed carry licensee in violation of this provision is guilty of a Class A misdemeanor for a first or second violation and a Class 4 felony for a third violation. Provides that the Illinois State Police may suspend a license for up to 6 months for a second violation and shall permanently revoke a license for a third violation. Amends the Criminal Code of 2012. Provides that for the aggravated unlawful possession of a weapon statute, "case" does not include an unlocked glove compartment, glove box, or center console of a vehicle. |

| SB1459 | 01/31/2025 | Amends the Tobacco Products Manufacturers' Escrow Enforcement Act of 2003. Provides that, upon a distributor's failure to submit certain information, the Attorney General may send a notice of violation to the distributor and provide 10 days to cure the violation. Provides that, if the distributor does not cure the violation, the Attorney General may notify the Director of Revenue of the violation, and, upon receiving the Attorney General's notice, the Director of Revenue shall revoke the distributor's license. Amends the Tobacco Product Manufacturers' Escrow Act. Provides that a tobacco product manufacturer that elects to place funds into escrow may make an irrevocable assignment of its interest in the funds to the benefit of the State. |

| SB1460 | 01/31/2025 | Amends the Firearm Owners Identification Card Act concerning the Firearm Transfer Inquiry Program. Provides that the Illinois State Police may charge a fee not to exceed $10 and any processing fee. Provides that the processing fees shall be limited to charges by the State Treasurer for using the electronic online payment system. Provides that $4 from each fee collected under this provision shall be deposited into the State Police Firearm Enforcement Fund. Currently, the Illinois State Police may utilize existing technology which allows the caller to be charged a fee not to exceed $2. |

| SB1461 | 01/31/2025 | Amends the Illinois Pension Code. In provisions authorizing certain persons to transfer service credit from IMRF to a downstate police pension fund, makes technical and combining changes to conform the changes made by Public Act 102-857 and Public Act 102-1061. Removes a restrictive date on the transfer of that service credit. Authorizes investigators for the Secretary of State and conservation police officers to transfer that service credit. Authorizes State's Attorneys to transfer service credit under the IMRF Article to the State Employee Article. In the State Employee Article, provides that a State policeman or conservation police officer may elect to convert service credit earned under the Article or, for certain types of service, elect to establish eligible creditable service under the alternative retirement annuity provisions by filing a written election with the Board of Trustees and paying to the System a specified amount. Provides that a participant under the alternative retirement annuity provisions may establish eligible creditable service for up to 7 years of service as a State's Attorney. Provides that any benefit increase that results from the amendatory Act is excluded from the definition of "new benefit increase". Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1462 | 01/31/2025 | Amends the Illinois Pension Code. In provisions authorizing certain persons to transfer service credit from IMRF to a downstate police pension fund, makes technical and combining changes to conform the changes made by Public Act 102-857 and Public Act 102-1061. Removes a restrictive date on the transfer of that service credit. Authorizes investigators for the Secretary of State and conservation police officers to transfer that service credit. Authorizes State's Attorneys to transfer service credit under the IMRF Article to the State Employee Article. In the State Employee Article, provides that a State policeman or conservation police officer may elect to convert service credit earned under the Article or, for certain types of service, elect to establish eligible creditable service under the alternative retirement annuity provisions by filing a written election with the Board of Trustees and paying to the System a specified amount. Provides that a participant under the alternative retirement annuity provisions may establish eligible creditable service for up to 7 years of service as a State's Attorney. Provides that any benefit increase that results from the amendatory Act is excluded from the definition of "new benefit increase". Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1184 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that a policeman who applies for disability benefits under the Article and has been denied reinstatement as a policeman by his or her employer because of a physical or mental incapacity shall be presumed to be disabled as that term is used in the Article. Provides that no policeman who otherwise meets the requirements for a disability benefit shall be denied a disability benefit unless and until the policeman's employer reinstates him or her as a policeman or offers him or her a limited-duty position. Provides that the changes apply retroactively to January 1, 2023. Provides that any policeman who has been denied a disability benefit without an offer of reinstatement or a limited-duty position after January 1, 2023 shall be entitled to retroactive disability benefits. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1185 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that a policeman who applies for disability benefits under the Article and has been denied reinstatement as a policeman by his or her employer because of a physical or mental incapacity shall be presumed to be disabled as that term is used in the Article. Provides that no policeman who otherwise meets the requirements for a disability benefit shall be denied a disability benefit unless and until the policeman's employer reinstates him or her as a policeman or offers him or her a limited-duty position. Provides that any policeman who has been denied a disability benefit without an offer of reinstatement or a limited-duty position after the effective date of the amendatory Act is entitled to disability benefits. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1186 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that if a policeman has an application for an ordinary disability benefit denied by the Board of Trustees of the Fund or has a duty disability benefit, ordinary disability benefit, or occupational disability benefit terminated by the Board and brings an action for administrative review challenging the termination or denial of the disability benefit and the policeman prevails in the action in administrative review, then the prevailing policeman shall be entitled to recover from the Fund court costs and litigation expenses, including reasonable attorney's fees, as part of the costs of the action. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1187 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that for Tier 2 policemen, "final average salary" is the greater of: (i) the average monthly salary obtained by dividing the total salary of the policeman during the 96 consecutive months of service within the last 120 months of service in which the total salary was the highest; or (ii) the average monthly salary obtained by dividing the total salary of the policeman during the 48 consecutive months of service within the last 60 months of service in which the total salary was the highest. Provides that the limit on salary for all purposes under the Code for Tier 2 policemen shall annually be increased by the lesser of 3% or the annual (instead of one-half of the annual) unadjusted percentage increase in the consumer price index-u, including all previous adjustments. Provides that the surviving spouse's annuity for certain Tier 2 policemen shall be 54% of the policeman's monthly salary at the time of the policeman's death. Provides that if the deceased policeman was a parent of a child or children and there is a surviving spouse, 12% of the policeman's monthly salary at the date of death, or 12% of the policeman's earned pension, shall be granted to the guardian of any such minor child or children. Provides that upon the death of the surviving spouse leaving one or more children under the age of 18, or upon the death of a policeman leaving one or more children but no surviving spouse, a monthly pension of 20% of the policeman's monthly salary at the date of death or 20% of the policeman's earned pension at the date of death shall be granted to the guardian of each such child until the child reaches age 18. Makes other changes. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1188 | 01/24/2025 | Amends the Chicago Teacher Article of the Illinois Pension Code. In a provision allowing a service retirement pensioner to be re-employed as a teacher for a specified number of days without cancellation of the service retirement pension, provides that if a service retirement pensioner works more than the number of days allowed under that provision in any school year, the service retirement pension benefit shall be withheld on a pro rata basis for each day worked in excess of the number of days allowed. Provides that if a pensioner who only teaches drivers education courses after regular school hours works more than 900 hours in any school year, the service retirement pension benefit shall be withheld on a pro rata basis for each period of 7.5 hours in excess of 900 hours. Provides that the changes made by the amendatory Act are retroactive to July 1, 2020. Provides that all service retirement pensioners whose service retirement pensions were cancelled as a result of re-employment as a teacher during the period of July 1, 2020 through the effective date of the amendatory Act shall have their overpayments recalculated on a pro rata basis consistent with the changes made by the amendatory Act, and the difference between the initial overpayment and the recalculated overpayment shall be refunded to those service retirement pensioners with interest. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1189 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that a policeman who applies for disability benefits under the Article and has been denied reinstatement as a policeman by his or her employer because of a physical or mental incapacity shall be presumed to be disabled as that term is used in the Article. Provides that no policeman who otherwise meets the requirements for a disability benefit shall be denied a disability benefit unless and until the policeman's employer reinstates him or her as a policeman or offers him or her a limited-duty position. Provides that any policeman who has been denied a disability benefit without an offer of reinstatement or a limited-duty position after the effective date of the amendatory Act is entitled to disability benefits. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1190 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that a policeman who applies for disability benefits under the Article and has been denied reinstatement as a policeman by his or her employer because of a physical or mental incapacity shall be presumed to be disabled as that term is used in the Article. Provides that no policeman who otherwise meets the requirements for a disability benefit shall be denied a disability benefit unless and until the policeman's employer reinstates him or her as a policeman or offers him or her a limited-duty position. Provides that the changes apply retroactively to January 1, 2023. Provides that any policeman who has been denied a disability benefit without an offer of reinstatement or a limited-duty position after January 1, 2023 shall be entitled to retroactive disability benefits. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB1191 | 01/24/2025 | Amends the Chicago Police Article of the Illinois Pension Code. Provides that if a policeman has an application for an ordinary disability benefit denied by the Board of Trustees of the Fund or has a duty disability benefit, ordinary disability benefit, or occupational disability benefit terminated by the Board and brings an action for administrative review challenging the termination or denial of the disability benefit and the policeman prevails in the action in administrative review, then the prevailing policeman shall be entitled to recover from the Fund court costs and litigation expenses, including reasonable attorney's fees, as part of the costs of the action. Amends the State Mandates Act to require implementation without reimbursement. Effective immediately. |

| SB0002 | 01/13/2025 | Amends the Illinois Pension Code. Makes changes to Tier 2 benefits, including changing the amount of the automatic annual increase to 3% of the originally granted retirement annuity or 3% of the retirement annuity then being paid for the General Assembly and Judges Articles, changing the limit on the amount of salary for annuity purposes to the Social Security wage base, changing the calculation of final average salary to the Tier 1 calculation for persons who are active members on or after January 1, 2026, and changing the retirement age. Establishes an accelerated pension benefit payment option for the General Assembly, Chicago Teachers, and Judges Articles of the Code. Provides that, with regard to persons subject to the Tier 2 provisions, a security employee of the Department of Human Services, a security employee of the Department of Corrections or the Department of Juvenile Justice, an investigator for the Department of the Lottery, or a State highway worker is entitled to an annuity calculated under the alternative retirement annuity provisions of the State Employee Article of the Code. Authorizes the conversion of service to eligible creditable service. Provides that the Retirement Systems Reciprocal Act (Article 20 of the Code) is adopted and made a part of the Downstate Police, Downstate Firefighter, Chicago Police, and Chicago Firefighter Articles. Authorizes SLEP status under the Illinois Municipal Retirement Fund for a person who is a county correctional officer or probation officer and for a person who participates in IMRF and qualifies as a firefighter under the Public Safety Employee Benefits Act. In the Downstate Firefighter Article, includes a de facto firefighter in the definition of "firefighter". Defines "de facto firefighter". Provides that the monthly pension of a firefighter who is receiving a disability pension shall be increased at the rate of 3% of the original monthly pension. Makes changes to the minimum retirement annuity payable to a firefighter with 20 or more years of creditable service, the minimum disability pension, and the minimum surviving spouse's pension. Makes other changes. Amends the State Mandates Act to require implementation without reimbursement by the State. Effective immediately. |

Alerts Sign-up

Alerts Sign-up