House Speaker Michael Madigan has a funny way of showing he is opposed to new taxes, Austin Berg argued on the Illinois Policy Institute's website recently.

"Madigan is the nation’s most powerful state legislative leader and the longest-serving state House speaker in U.S. history," Berg, a senior write for the group, contends. "And one of the ways in which Madigan asserted dominance in his early years as speaker was by blocking tax increases backed by Republican Gov. Jim Thompson. “I am not in favor of raising taxes,' Madigan said in a 1985 interview. 'If the governor wishes to advance a proposal to raise taxes, then I think he should travel around the state and build a consensus for the tax increases and bring it back to the Legislature.'"

Yet now one of the major sticking points between Madigan and Gov. Bruce Rauner has been the former's demand for a large tax increase and sales tax expansion -- which it looks like he'll get, Berg wrote.

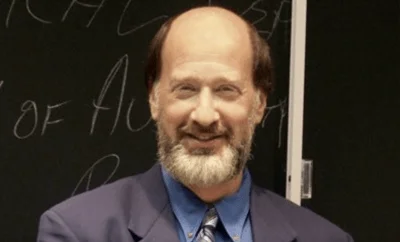

House Speaker Michael Madigan (D-Chicago)

| By illinoislawmakers - https://www.youtube.com/watch?v=H7C51rHSd6w, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=30435112

"Rauner just blinked," Berg wrote. "His administration gave its blessing to a GOP budget plan that includes the $5.4 billion tax hike Illinoisans first saw in the Senate’s failed 'grand bargain.' Dubbed the 'Capitol Compromise,' the plan starts with a 33 percent income tax increase, and contains new taxes on services such as Netflix, laundry services and more. Each Illinois household would eventually have to pay $1,125 in additional taxes annually under this plan."

Ultimately, Berg contends, Madigan isn't as concerned with what a tax hike would do as he is with his own position in the state.

“When questioned over the years on his policy positions, Madigan usually resorts to bromides about how he supports the Democratic Party and its fight on behalf of the middle class,” Berg wrote. "Because of Madigan’s distaste for policy principles, an observer of his more than 40 years in state government will find the speaker has taken a number of contradictory stances on a variety of issues. What do those positions have in common? Pursuit of political power.”

Berg examines a budget row between Madigan and former Republican Gov. Jim Thompson in 1985, just two years after Madigan became speaker. Thompson wanted a permanent income tax hike. Madigan flatly opposed it and challenged Thompson to travel the state to gain support if he wanted to see it brought to a vote, Berg wrote.

Recently, Rauner and the state’s Republican lawmakers have grudgingly bowed to pressure and said they will accept an income tax hike in exchange for a property tax freeze. Berg argues that taxpayers should look at Madigan’s comments on the tax issue in 1989:

"For the past two years, I have said Illinois does not need a 40 percent increase in taxes,” Madigan told the Chicago Tribune at the time. “The government of Illinois does not need to grow anymore.”

Berg said those words echo now.

“Despite the crippling budget impasse, Illinois government is spending at record levels under a mix of court orders and consent decrees," he wrote. "The Republican solution to this problem – devastating tax hikes – is baffling for a number of reasons. Chief among them is the havoc it will wreak on households across the state.”

Illinois has not had a full-year budget for two years and is facing a third such year, which promises to bring even more troubles to the state in the form of a lower credit rating and debt piled on top of debt. Republicans have indicated their approval of a plan to increase the state income tax by 33 percent for four years, along with an expansion of the state sales tax to previously untaxed services.

.jpg)

Alerts Sign-up

Alerts Sign-up