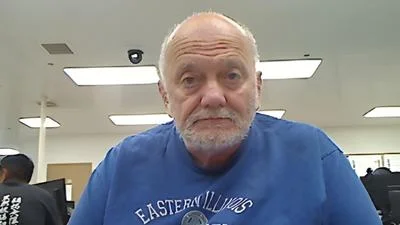

Northwest Side GOP Club Vice President Ammie Kessem

Northwest Side GOP Club Vice President Ammie Kessem

Northwest Side GOP Club Vice President Ammie Kessem (R-Chicago) can sum up Chicago's financial crisis in a couple of choice phrases that leave no doubt as to who is to blame.

“All these pension holidays and mismanagement of those funds . . . it’s time that we elect individuals who have the moral fortitude to refrain from this type of fiscal irresponsibility,” Kessem, a candidate for 41st Ward committeeman, told Chicago City Wire. “The bottom line is that we should have never gotten to this level of such gross incompetence in city and state government.”

Kessem cites as an example of perpetuating the long tradition of poor fiscal decision-making the city's new tax on business being proposed by counsel to the Multistate Tax Commission and former Illinois Director of Revenue Brain Hamer, which she believes will ultimately will do more harm than good. Hamer’s proposed levy would come in the form of a less than 1 percent margin tax on "businesses that conduct business in Chicago, minus certain labor costs."

Former Illinois Director of Revenue Brain Hamer

“I understand that the current administration inherited this disaster, but what cuts have they made to fix the problem?” Kessem asked. “The Democrats' answer to everything is to raise taxes. They don’t seem to comprehend the fact that higher taxes drive people and businesses away.”

The Washington, D.C.-based Tax Foundation agrees with Kessem's analysis, finding that "business-to-business transactions are not exempt from gross receipts taxes, which creates tax pyramiding . . . which compounds the tax's economic effects. This distorts economic decision-making, incentivizing firms to vertically integrate, change industries and leave the taxing jurisdiction.”

During her recent State of the City Address, first-term Chicago Mayor Lori Lightfoot bemoaned the city’s projected 2020 budget shortfall of $838 million and warned that an even greater debt load could soon be the reality.

“A Chicago margin tax may be criticized by some potential taxpayers, but the fact is that no realistic alternative exists,” Hamer said in a commentary penned in the Chicago Tribune. “Such a tax would spread the burden over a large number of business enterprises, rather than burdening the same pool of property taxpayers that have been required to shoulder the burden over and over again. It also would shield small businesses and homeowners from additional taxes and fees that many of them simply cannot afford. And it would enable the city to meet its obligations and finally put its fiscal house in order.”

Kessem counters that there is a far simpler solution.

“I want to see cuts in the budget, not tax increases,” she said.

Alerts Sign-up

Alerts Sign-up