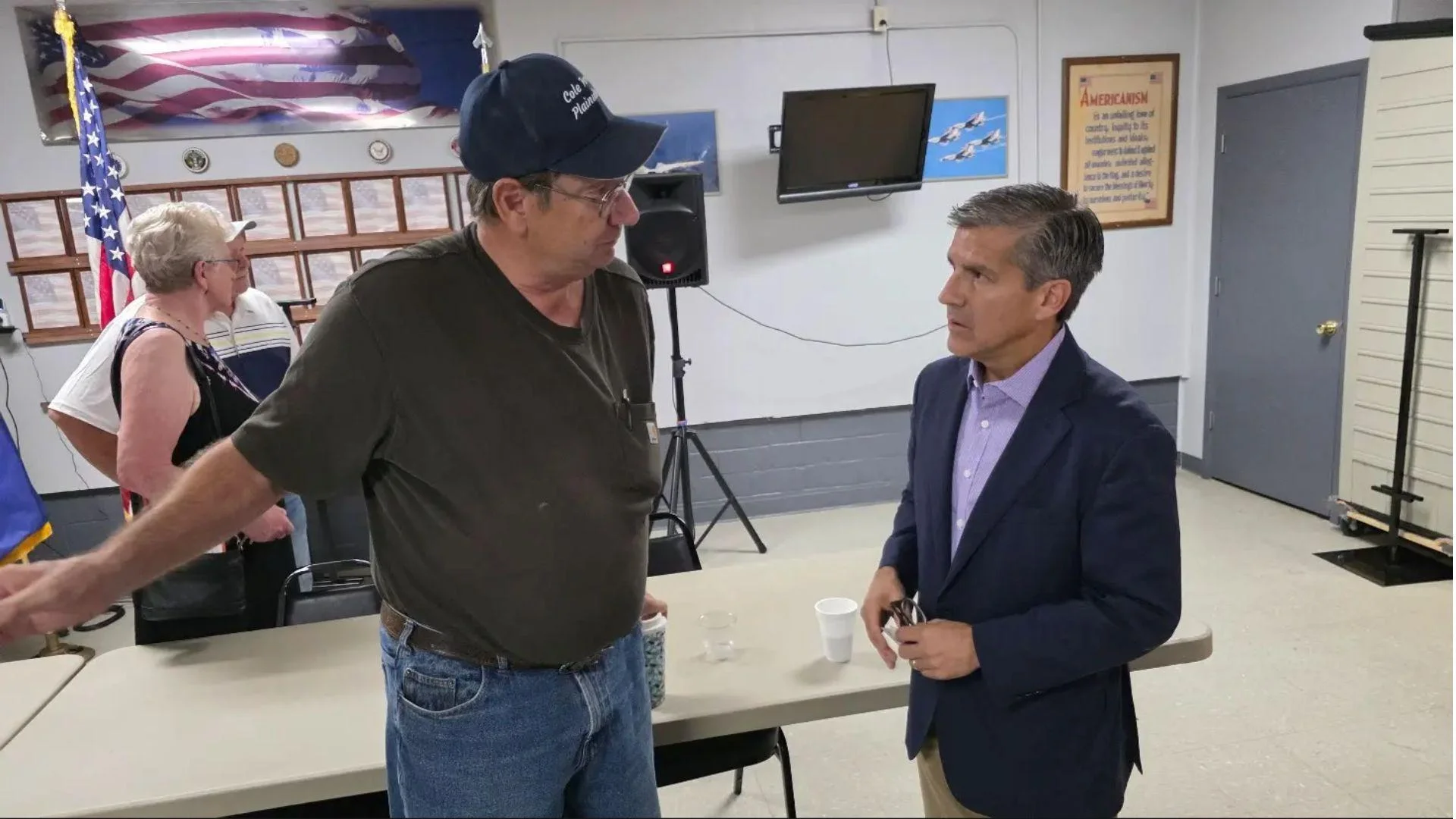

Ted Dabrowski, Gubernatorial Candidate for Illinois pictured with Dan Cole, a farmer from the Quincy area | Provided

Ted Dabrowski, Gubernatorial Candidate for Illinois pictured with Dan Cole, a farmer from the Quincy area | Provided

Ted Dabrowski, a candidate for governor of Illinois, recently met with Quincy-area farmer Dan Cole at the American Legion's Conservative Breakfast. The meeting aimed to highlight how Illinois' declining competitiveness compared to neighboring states is affecting border residents as people and businesses shift purchases—and even relocate—across state lines.

According to the Swiss Journal of Economics and Statistics, border dynamics intensify tax-driven arbitrage in communities like Quincy, which is located directly across the Mississippi River from Missouri. When adjacent states offer significantly lower tax burdens, households and firms tend to substitute purchases and even domicile choices to capture savings. Research on cross-border shopping indicates that price and tax differentials shift retail activity and erode local tax bases near borders. This pattern is consistent with residents traveling short distances to buy fuel, cigarettes, or spirits—and over time considering moves—whereafter the fiscal impact compounds for the higher-tax side.

As per the Tax Foundation, Illinois posts markedly higher taxes than Missouri across multiple categories frequently purchased near borders. Illinois’ effective property tax rate is the nation’s highest at 1.87% compared to Missouri’s 0.78%. Additionally, Illinois’ gasoline tax is the nation’s second-highest at $0.66 per gallon, compared with Missouri’s $0.27. The cigarette tax in Illinois stands at $2.98 per pack while Missouri’s is $0.17, the lowest nationally. Moreover, Illinois’ spirits excise is $8.55 per gallon versus Missouri’s $2.00. These gaps create clear incentives for cross-river purchases and business siting.

IRS migration records underscore fiscal competitiveness pressures: between 2021 and 2022, Illinois experienced a net loss of 45,460 income-tax filers due to interstate migration, ranking among the largest outflows nationally. While many destinations are Sun Belt states, the broader pattern aligns with households seeking lower combined tax burdens and living costs; such flows tend to be most acute where relocation frictions are small, including border metros where interstate moves can preserve jobs and family networks while reducing ongoing expenses.

Dabrowski brings over three decades of experience in international finance and domestic policy leadership. He spent 16 years in senior financial roles, including as Head of Corporate Banking at Citibank in Poland, where he advised the government on economic liberalization and managed multi-billion-dollar Treasury portfolios in Poland and Mexico. After returning to the U.S., Dabrowski became Vice President of Policy at the Illinois Policy Institute and later served as President of Wirepoints, a nonprofit focused on Illinois’ economy and government issues. His research has been cited by national outlets including The Wall Street Journal. He holds a master’s degree in public policy from the University of Chicago, an MBA in finance from the Wharton School, and a bachelor’s degree from Georgia Tech.

Alerts Sign-up

Alerts Sign-up